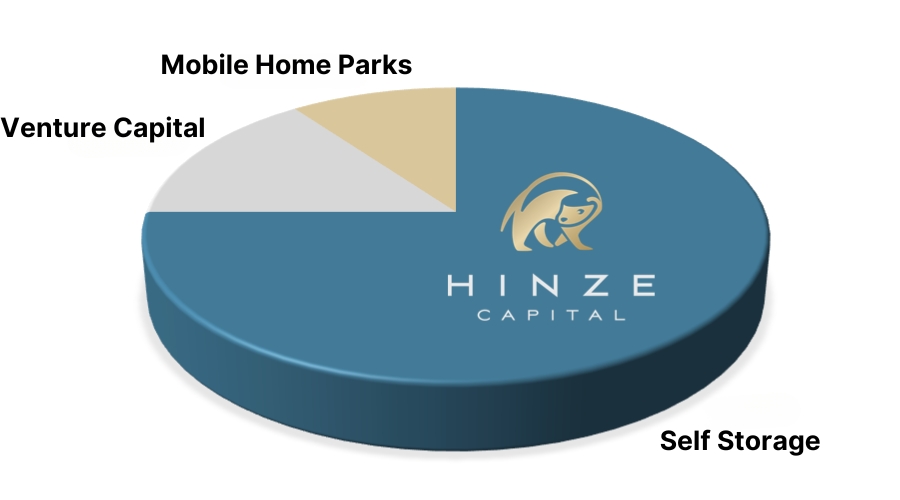

Hinze Capital is a private investment firm specializing in value-add real estate and late-stage venture capital investments with proven business models. Founded in 2014, we target high-yield opportunities across multiple asset classes, including self-storage, RV parks, and multifamily properties.

With over a combined 45 years of experience, our senior leadership has been involved in more than $2.2 billion in real estate acquisitions and dispositions across the U.S., Europe, and Latin America. We focus on identifying undervalued properties in high-growth markets that have been mismanaged, implementing strategic value-add initiatives to unlock their full potential.

Our sweet spot is properties in the $10-50 million range, where we can aggregate portfolios in less competitive markets and drive substantial value through branding, marketing, redevelopment, and operational improvements.

Headquartered in Dallas, TX, we leverage a deep network of private real estate owners and developers to source off-market deals and create strategic partnerships. At Hinze Capital, we take an opportunistic, entrepreneurial approach to discovering hidden value and maximizing investment returns.

Hinze Capital uses a common sense investment approach to acquiring underperforming properties and businesses and implementing best practices in operations, technology, marketing, accounting, reporting and profitability.

Great businesses are built by great people. We invest in the right teams and empower them to succeed.

Technology gives us the edge—so we use the best tools to stay ahead of the curve.

We don’t just collect assets; we create value, improve operations, and maximize potential.

We’re here for the long haul—balancing strategic vision with the flexibility to pivot when needed.

Honesty and transparency aren’t optional—they’re how we do business, build trust, and drive results.

We believe in a common sense approach to investing in and managing a property.